how does maine tax retirement income

See below Pick-up Contributions. June 6 2019 239 AM.

State Taxes For Retirees Social Security Pensions Military

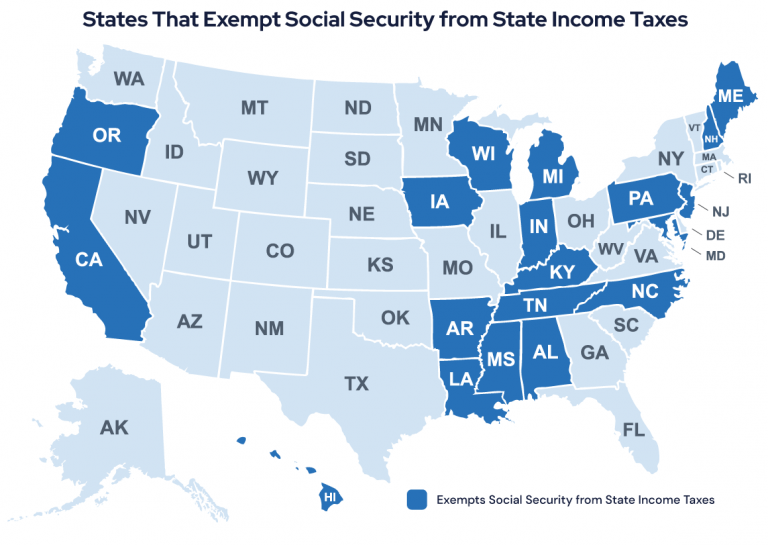

If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation.

. Personalized Strategies and Ongoing Guidance to Help you Reach Your Financial Goals. The income tax rates are graduated with rates ranging from 58 to 715 for tax. The exemption increase will take place starting in January 2021.

Ad Learn More From One of Our Trusted Financial Advisors Today. If you believe that your refund may be. The income tax rates are graduated with rates ranging from 58.

However that deduction is reduced in an amount equal to your annual Social. Retirement account contributions have special tax-favored status. Take-Home Pay These are the taxes owed for the 2021 - 2022 filing season.

For questions on filing income tax withholding returns electronically email the Withholding Unit at withholdingtaxmainegov or call the Withholding line at 207 626-8475 select option 4. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

For tax years beginning on or after January 1 2016 benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Disability income received from MainePERS that is reported as wages on your federal income tax return. Less than 44950 for joint filers High.

Maine Income Tax Range. Ad Learn More From One of Our Trusted Financial Advisors Today. 715 on taxable income of 53150 or.

For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. To All MainePERS Retirees. The US Congress voted and approved in 1978 Title 26 US.

Personalized Strategies and Ongoing Guidance to Help you Reach Your Financial Goals. Subtract the amount in Box 14 from. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. Benefit under a qualified domestic relations order does not qualify for this deduction. Total Income Taxes.

The Pension Income Deduction. You will have to. Maine allows for a deduction of up to 10000 per year on pension income.

To enter the Pension. 58 on taxable income less than 22450 for single filers. Increased the exemption on income from the state teachers retirement system from 25 to 50.

According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. On the other hand if you. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a.

Maine generally imposes an income tax on all individuals that have Maine-source income. Retirement income The Back Story. The 10000 must be reduced by all taxable and nontaxable social.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

7 States That Do Not Tax Retirement Income

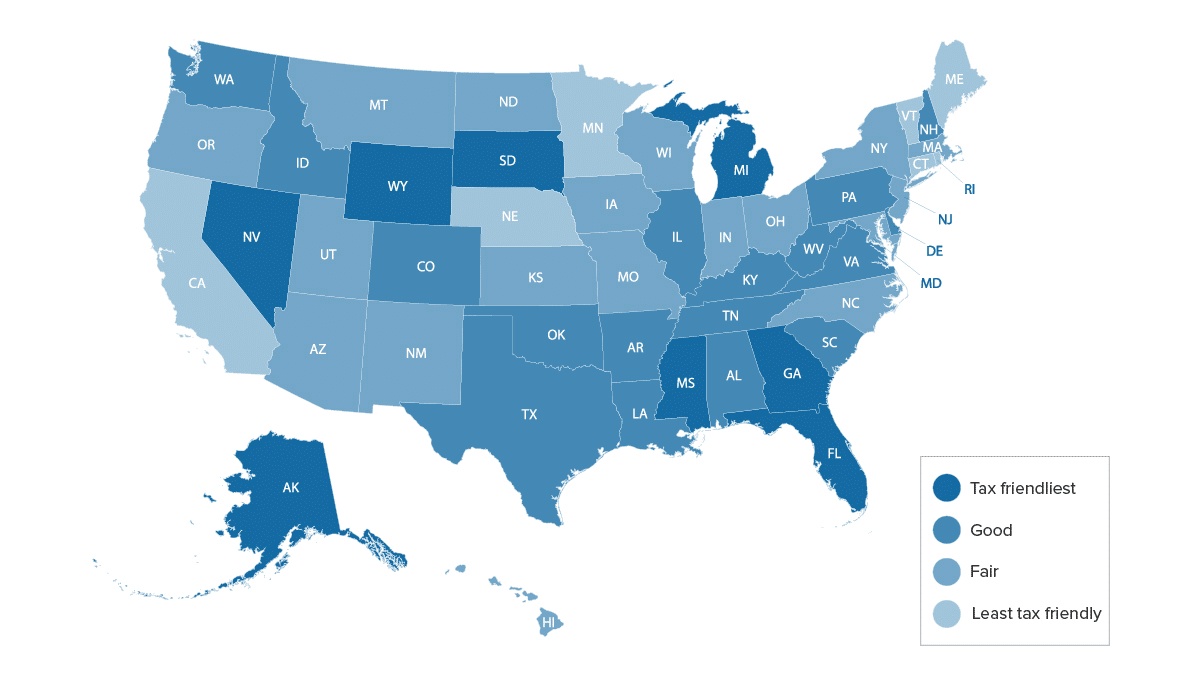

Most Tax Friendly States For Retirees Ranked Goodlife

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

37 States That Don T Tax Social Security Benefits The Motley Fool

State Corporate Income Tax Rates And Brackets Tax Foundation

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

States That Won T Tax Your Retirement Distributions Retirement Fund Retirement Budget Retirement

States That Don T Tax Retirement Income Personal Capital

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

Most Tax Friendly States For Retirees Ranked Goodlife

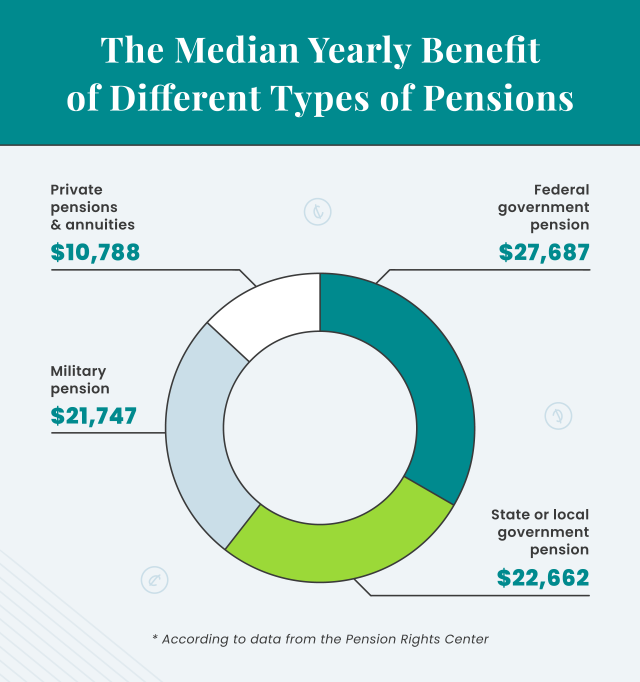

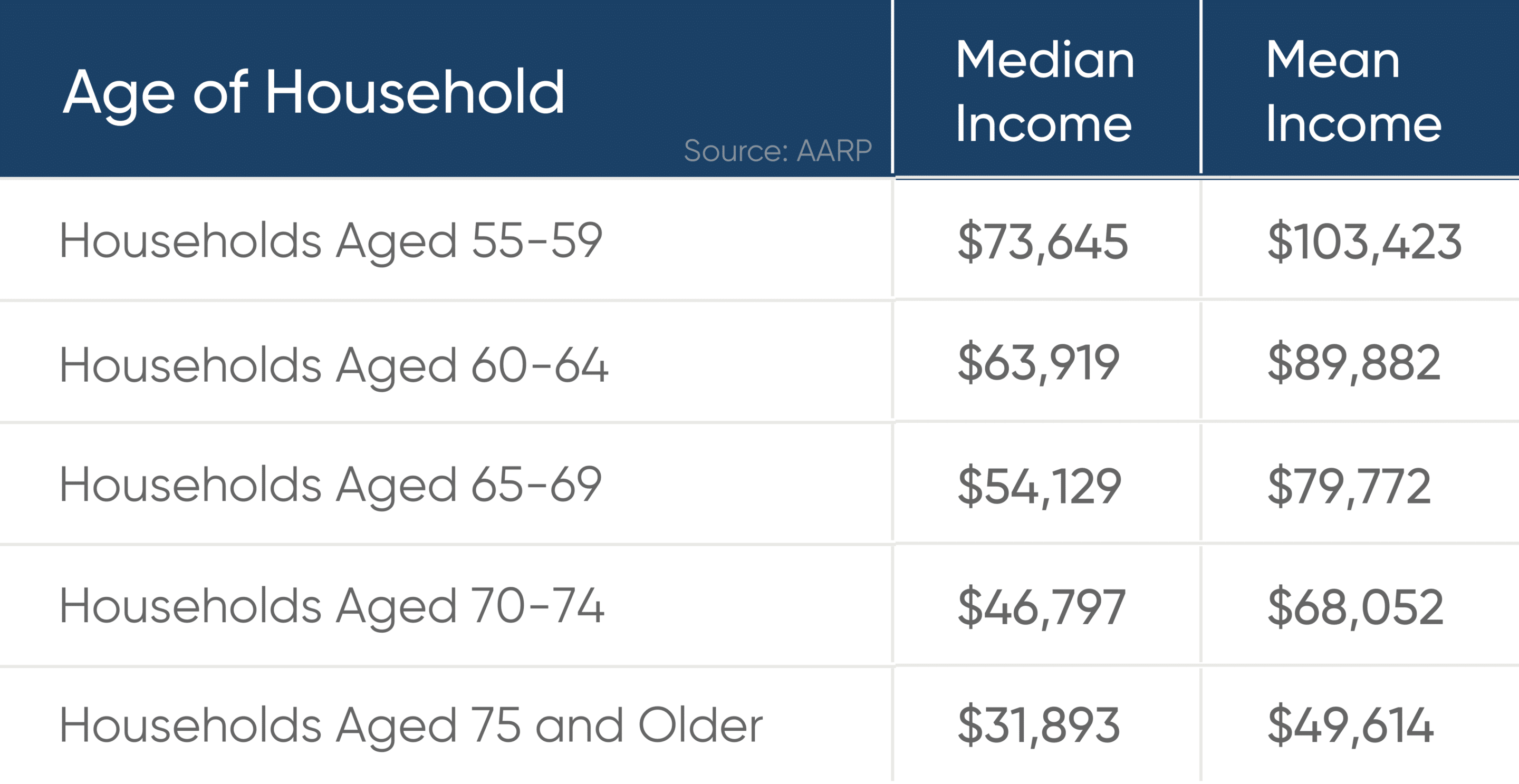

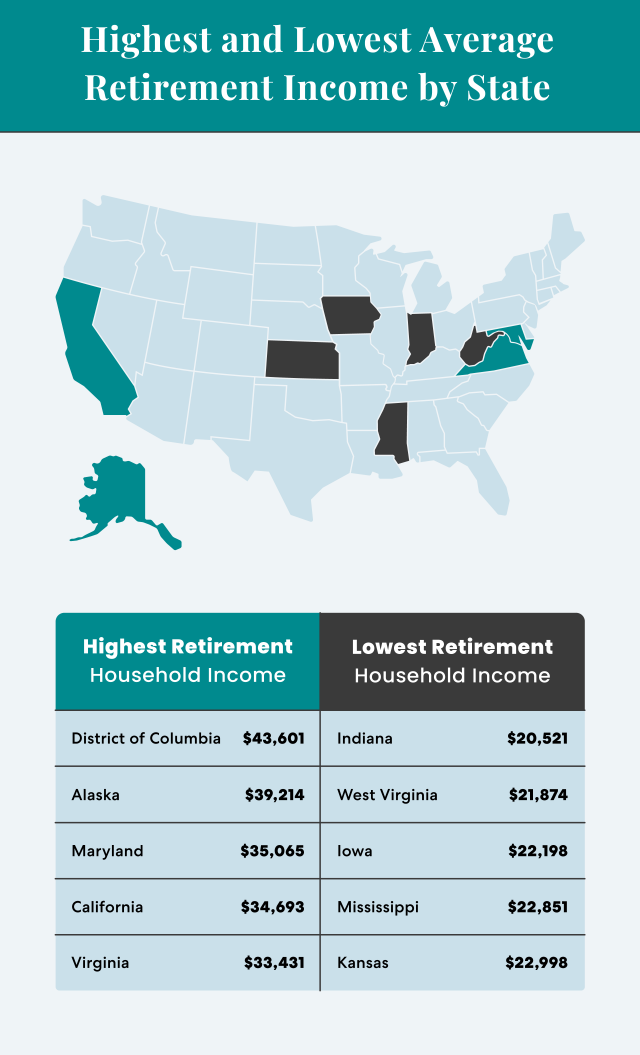

Average Retirement Income Where Do You Stand

Average Retirement Income For Seniors Goodlife Home Loans

Average Retirement Income Where Do You Stand

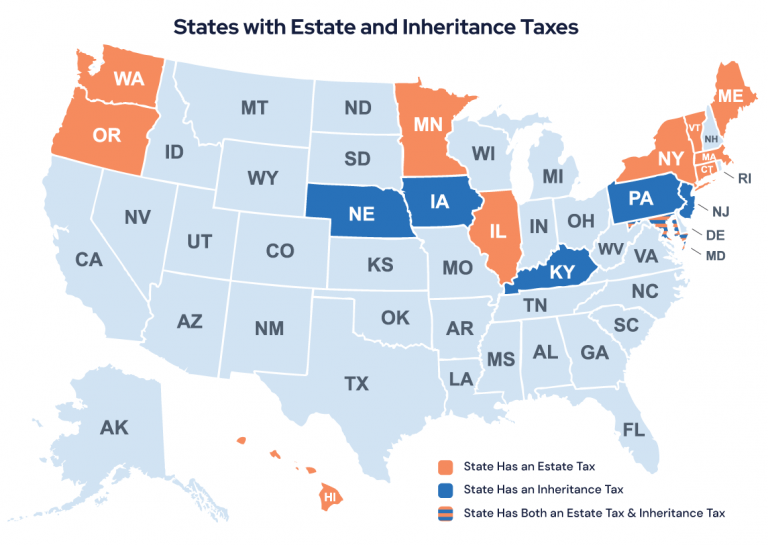

State Taxes For Retirees Social Security Pensions Military

14 States Don T Tax Retirement Pension Payouts Retirement Pension Pensions Retirement

Taxes The Most And Least Friendly States For Retirees Pictures Of The Week National Parks Furnace Creek

Tax Withholding For Pensions And Social Security Sensible Money